Will Renewable Power Generation Outpace Coal and Natural Gas?

Data from the U.S. Energy Information Administration is bright regarding solar and wind, but will clean energy surpass coal and natural gas?

Data from the United States Energy Information Administration (EIA) contains a glowing outlook on clean energy deployment in the years ahead. With solar and wind leading growth, the agency expects steady increases in renewable power generation will reduce that of power plants running on coal and natural gas by the end of 2024.

Solar and wind. Image used courtesy of Pixabay

Since several new solar and wind projects entered America’s power grid last year, the EIA predicts that both energy sources will grow modestly in 2023 to claim 16% of total generation—up from 14% in 2022—and then 18% in 2024. Meanwhile, generation from coal is expected to fall from a 20% share last year to 18% in 2023 and 17% the following year, while natural gas drops from 39% in 2022 to 37% next year.

These changes only amount to a few percentage points, but they still represent an incremental rise in renewables’ share of the U.S. power mix. Solar photovoltaic capacity totaled 74 gigawatts (GW) last year, three times that of 2017. And out of all power generation sources, solar’s share is slated to grow from 3% in 2022 to 5% this year and 6% in 2024.

At the same time, wind capacity exploded by over 60% throughout the last five years, reaching 143 GW. However, new activity has slowed with rising construction costs. Wind’s projected share of total generation remains virtually unchanged from last year, at around 11% on average, then increasing to 12% in 2024.

This chart from the Energy Information Administration shows historical and projected increases in renewables’ share of electricity generation in the U.S. Image used courtesy of the EIA

The EIA says that the forecasted growth in renewables over the next two years comes as declining natural gas fuel costs have made coal a less competitive electricity source. After notable increases in mid-2022, natural gas spot prices are projected to fall by more than $1.50 per million British thermal units (MMBtu) this year, averaging $4.90 MMBtu, as production rises via completed pipeline expansions.

Solar Expansion Outpaces Wind

The EIA data comes after the agency previously reported last September that in the first six months of 2022, renewables’ share of utility-scale electricity generation grew to 24%, up from 21% over the same period in 2021.

Many solar and wind projects are scheduled to come online in the coming years. The EIA says planned projects will boost solar’s capacity by 84% (or 63 GW) in 2024, thanks to falling construction costs and new clean energy tax credits.

This map shows the utility-scale generating units expected to come online through October 2023. Image used courtesy of the EIA

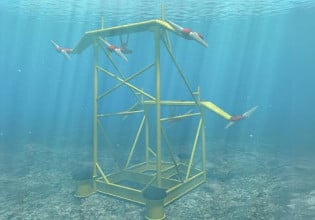

Wind project development hasn’t reached solar’s heights, though, with only 12 GW of capacity expected to be added over the next two years. A decent portion will come from offshore wind projects: The EIA reported in mid-2022 that power plant developers/operators would install more than 6 GW of offshore wind capacity by 2029.

Contrast that with EIA statistics from 2020, when developers installed a record 14.2 GW wind turbine capacity in anticipation of the full value of the wind energy Production Tax Credit expiring later that year.

Wind activity has slowed partly because of increased construction costs. The latest data reported by the EIA on this subject comes from 2020, when the average construction cost for onshore wind turbines increased by 8%. Large wind farms with over 200 megawatts (MW) of capacity saw average construction costs rise by 11%, while smaller wind farms under 100 MW averaged an even higher increase of 53%.