Hydrogen to Gain Momentum as Low-Carbon Resource in Energy Transition

A report from British consulting firm GlobalData spotlights trends and advancements in the low-carbon hydrogen market. Let’s unpack the takeaways.

United Kingdom-based research and consulting firm GlobalData recently published an exhaustive report profiling the market for hydrogen as a low-carbon resource in the global transition to renewables.

A rendering of the West Guiana Power Plant under construction in French Guiana. Scheduled for commissioning in 2024, the 128 MWh plant will combine a 55 MW solar PV farm, a 16 MW electrolyzer, a hydrogen storage system, and fuel cells. Image used courtesy of Meridiam

Low-carbon hydrogen—that is, hydrogen produced with little to no greenhouse gas emissions—accounts for a small fraction (0.89%) of the global demand for pure hydrogen, which totaled 74 million metric tons annually in 2021. Still, GlobalData expects this trajectory to shift as the resource has gained significant policy support and government commitments worldwide to scale up investments.

The cost of low-carbon hydrogen production is projected to decline by up to 60% over the next ten years, coinciding with the falling cost of renewable electricity and ultimately leading to lower prices in retail and end-applications. This is significant because of the range of markets hydrogen serves, from transportation to aerospace and defense to industrial and construction sectors.

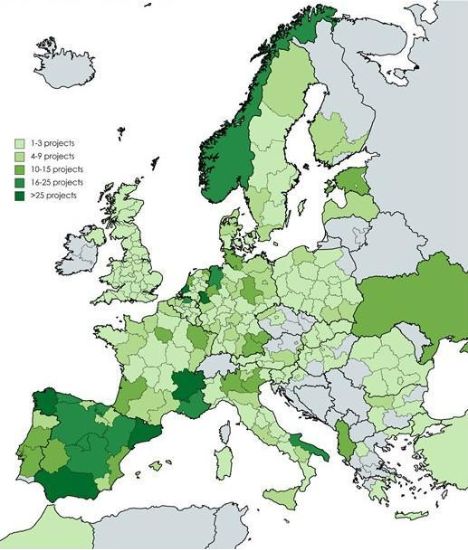

GlobalData spokesperson Besta Shankar told EE Power that Europe leads the market in the total number of projects it’s working to bring to fruition.

“The European Union has made noteworthy developments in reducing its greenhouse gas emissions owing to factors like the execution of EU and national policies and mandates, a transition from coal to gas for power generation, and growing usage of renewables which have a positive impact on the production of low-carbon hydrogen production in Europe,” Shankar said.

Capacity Growth and Project Pipeline

The 218-page report published last month shows North America leads in clean hydrogen active production capacity, with 1.3 metric tonnes per annum (MTPA), followed by the Middle East, Africa, Europe, Asia-Pacific, and South and Central America.

Chart of worldwide low-carbon production capacity based on GlobalData’s scenarios. Image used courtesy of GlobalData

As of February 2023, global low-carbon hydrogen production capacity totaled 1,698 kilo-tonnes per annum (KTPA). GlobalData modeled two scenarios to gauge future production levels. First, its high-case scenario projects that global production will reach 1,11,326 KTPA by 2030. Shankar said this metric depends on various factors.

“The high-case scenario considers parameters like proper infrastructure, investment, project approvals, and high adoption rate among others, which may boost the production capacity,” Shankar said.

Meanwhile, GlobalData’s low-case scenario pins global capacity at 66,321 KTPA by 2030. Shankar said the low-case scenario considers challenges related to production facilities and delays that may hinder overall operations.

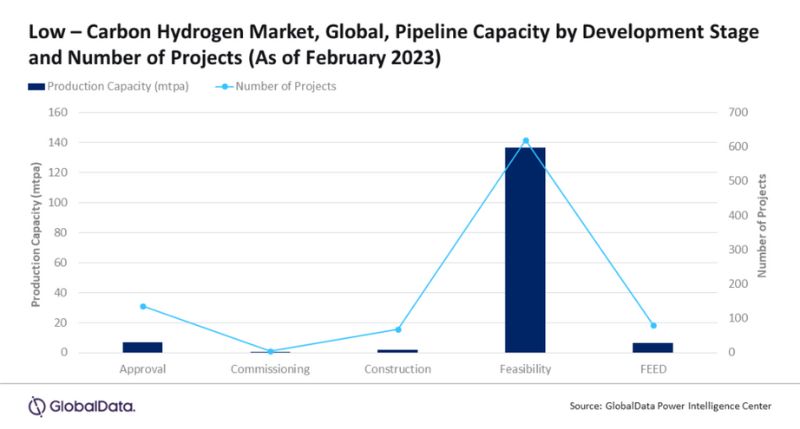

Funding-level planning, regulatory improvements, and proper infrastructure could accelerate the pace of projects in the coming years. Still, the development pipeline is fairly strong, totaling 152 MTPA across more than 900 announced and planned projects. Of that, 619 projects are in the feasibility stage, 136 are undergoing the approval process, 80 are in the front-end engineering design (FEED) phase, and 67 are under construction.

Low-carbon hydrogen market pipeline capacity by project count and development status. Image used courtesy of GlobalData

Technology Trends and Costs

GlobalData’s report tracks technology advancements and trends in the low-carbon hydrogen space. The market is driven by the rising adoption of hydrogen refueling stations (with over 700 deployed globally), hydrogen’s expansion to the heating/energy sector, and advancements in hydrogen pipelines.

Also playing a role is the growing interest in green hydrogen, which uses electrolysis and is powered by renewable energy, unlike blue hydrogen (derived from natural gas) and gray hydrogen (from unabated fossil fuels).

In 2022, steam methane reforming primarily dominated the different techniques for producing low-carbon hydrogen, with an 87% capacity share, followed by electrolysis and coal gasification. However, electrolysis’ share is expected to grow from 6.4% today to 91.8% by 2030 because it’s cost-efficient and shows promise in using renewable and nuclear resources.

Natural gas is the leading energy source for low-carbon hydrogen production, followed by coal and solar. However, GlobalData anticipates wind will replace this status quo in the coming years as several projects consider wind as an energy source.

As for costs, Shankar said production expenses vary based on resource location and availability.

“The prices of fossil fuels, the application of reformation technology to create hydrogen, the expenditure of carbon capture and long-term storage, and the cost of renewable energy, electrolysers, and water utilized to create hydrogen are major factors that determine the end price of hydrogen,” Shankar added.

Market Players

GlobalData’s report ranks Texas-based Green Hydrogen International as the dominant competitor in the market, capturing a major share. The company unveiled plans last year to build the world’s largest clean hydrogen production/storage hub in Texas, called “Hydrogen City,” powered by 60 GW of solar and wind power and producing over 2.5 billion kilograms of green hydrogen annually. Hydrogen will be converted to green ammonia, sustainable aviation fuel, and other derivatives or delivered via pipelines to power plants statewide.

Other leading players include H2 Clean Energy, an Australian company providing hydrogen refueling services serving as the link between green hydrogen producers and end-user vehicle fleets. The report also mentions Hong Kong-headquartered InterContinental Energy Corp., which is developing a handful of green hydrogen projects in Australia and the Middle East, and Australia-based Fortescue Future Industries, with several projects in its home country and Argentina, the Democratic Republic of the Congo, and Brazil.

Policy-Driven Macro Trends

GlobalData reports that much interest in the hydrogen market for renewables centers around government funding, mandates, and net-zero targets across the U.S., Canada, Australia, and India, and European countries such as Germany, Spain, and France. GlobalData also mentions that the World Bank Group formed a Hydrogen for Development Partnership in 2022 to increase hydrogen deployment in developing countries.

Worldwide, policies primarily focus on ramping up production capacity, cutting costs, and improving supply chain infrastructure to make way for the incoming rise in hydrogen projects.

Some rely on federal funding injections. For example, Australia recently introduced a $2 billion Hydrogen Headstart program in its 2023 budget, targeting large-scale projects through competitive hydrogen production contracts. The U.S.’s $740 billion Inflation Reduction Act, signed in 2022, takes a tax credit approach, subsidizing up to $3 per kilogram of green hydrogen produced from renewable electricity through 2032.

A map of Europe’s hydrogen project pipeline. Image used courtesy of the European Clean Hydrogen Alliance

Meanwhile, the U.K. recently upped its 2030 hydrogen production capacity target to 10 GW. And the European Union—where hydrogen claims less than 2% of energy consumption—aims to produce 10 million tonnes of renewable hydrogen and import another 10 million tonnes before 2030.

The European Commission has formed various public-private groups to facilitate upcoming activities. For instance, the European Clean Hydrogen Alliance includes more than 840 hydrogen projects across Europe, with many expected to begin operating by the end of 2025.