ON Semiconductor Rebrands and Sets Sights on New Sustainability Efforts

Changing its name to onsemi, Arizona-based power giant ON Semiconductor announced plans to expand its reach in the industrial and automotive markets and achieve net-zero emissions by 2040.

Soon after posting record revenue gains for the second quarter, Phoenix-based power electronics giant ON Semiconductor has unveiled a new brand identity, “onsemi.” Under the new name, the company vows to step up its investments and strategic expansions in its industrial and automotive end-markets and reach net-zero emissions by 2040.![]()

ON Semiconductor has rebranded to onsemi. Image courtesy of onsemi, via Twitter

The company aims to advance its position as a top provider of intelligent power and sensing products, facing heightened demand in electric vehicle applications, advanced safety systems, factory automation, and alternative energy solutions.

Hassane El-Khoury, onsemi’s president and CEO, said in the announcement that his team spent the last several months focusing on sharpening the company’s market strategy and realigning its product portfolio and investments.

“We are creating intelligent power and sensing technologies to enable our customers’ success, drive a better future for next generations, and create value for our shareholders, always with an eye on sustainability to make the world a better place for everyone,” El-Khoury added.

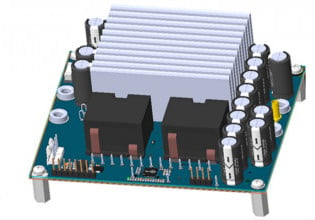

Onsemi recently unveiled a series of new releases targeting its automotive and industrial customers, including a lineup of silicon carbide (SiC) MOSFET module solutions for EV charging, as well as new converter-inverter power factor correction modules for industrial motor drives, servo drives, and HVAC systems.

After announcing its name change to “onsemi,” ON Semiconductor’s team joined in New York City to ring the Nasdaq opening bell on Aug. 4. Image courtesy of Nasdaq, via Twitter

In announcing the rebrand, onsemi said it plans to drastically reduce its emissions footprint over the coming decades, noting its industrial and automotive end-markets account for the majority of the world’s greenhouse gas emissions. Onsemi is far from the only chipmaker to adopt zero-emissions ambitions, though. Last year, the Taiwan Semiconductor Manufacturing Company (TSMC) was the first chip company to join the RE100, an initiative to get the world’s top businesses committing to 100% renewable energy targets. Intel, Applied Materials, Arm, Infineon Technologies, United Microelectronics Corporation and other chipmakers followed suit after TSMC.

Onsemi’s brand refresh and zero-emissions announcement comes as the company reported record revenues for the second quarter of this year. Its net sales topped $1.6 billion, up 13% from last quarter and 38% from the second quarter of 2020. In the earnings announcement, El-Khoury said the results were driven by ongoing structural changes to its business processes, coupled with a strong demand environment across the automotive and industrial end-markets.

In the earnings call, El-Khoury noted record automotive revenues topping $556 million, driven by the company's power and sensing product categories. Its industrial end-market—comprising military, aerospace, and medical customers—posted $434 million for the quarter, accounting for about one-fourth of its total revenue.

El-Khoury said the company is seeing continued demand for high-power modules and alternative energy applications, given the increased investments in utility-scale solar installations worldwide. In its industrial automation category, onsemi also saw yearly revenue growth for its imaging products, driven by machine vision and scanning applications.

In the second quarter, onsemi’s power solutions group unit accounted for most of its revenue with $846.6 million, up 13% from the previous quarter and 37% year-over-year. Its advanced solutions group netted $607.6 million in revenue, marking a 14% jump from last quarter and up 42% from last year. Its intelligent sensing segment grew 6% sequentially and 28% year-on-year, recording $215.7 million in revenue.

“As we continue to drive operational efficiencies in our manufacturing sites, we expect to see incremental supply and revenue growth in the second half of 2021,” El-Khoury stated in the earnings announcement.