Earnings Analysis: What do EV Makers’ Sales Mean?

Recent earnings reports from several leading automakers show solid sales figures as they make headway in the electric vehicle market. Here’s the latest from GM, Ford, Toyota, and Volkswagen, and what it means.

In their latest quarterly earnings, several leading automakers have reported growing traction in the electric vehicle market.

The Ford Mustang Mach-E electric SUV was among the best-selling EVs in the U.S. last year, behind Tesla’s Model Y and Model 3. Image used courtesy of Ford

Here, we’ll unpack the results of four car giants investing heavily in their respective EV expansions, including General Motors, Ford, Toyota, and Volkswagen. All are competing with market-dominant Tesla, whose revenue jumped 24% year-over-year in the first quarter to $23.3 billion, citing growth in vehicle deliveries (422,975 total) and other parts of its business.

General Motors

General Motors released its first-quarter 2023 earnings in late April with $40 billion in revenue and 864,000 vehicle sales. The Michigan-based auto giant clocked record quarterly EV sales in the U.S., totaling 20,700 units compared to 16,300 last quarter and 15,200 in Q3 2022. That brings its share of America’s EV market to 8.4%, up from 7.7% in Q4.

In a presentation to investors, the company mentioned plans to build about 50,000 EVs in the first half of this year, then double that number in the second half. It’s on track to produce 400,000 EVs in North America before mid-2024 and reach a capacity of 1 million units by 2025, with over $50 billion in revenue coming from its EV segment.

EV production is ramping up at GM’s plants in Tennessee, Michigan, and Canada. Meanwhile, the company is increasing cell production at its Ultium Cells manufacturing plant in Ohio. It plans to open another battery cell plant in Tennessee by the end of this year.

A slide from General Motors’ Q1 2023 earnings release. Image used courtesy of GM

EE Power profiled GM’s massive EV expansion in January, with its flagship Chevrolet Bolt EV and EUV models totaling 38,000 U.S. deliveries in 2022 and climbing the ranks among the best-selling EV series. That trajectory continues as the company enters the next phase of its EV push. This year, it’s debuting several vehicles powered by its Ultium battery platform, including the GMC Hummer electric pickup and SUV, and Chevrolet’s Silverado EV WT, Blazer EV (launching this summer), and Equinox EV (fall 2023) models. Silverado EV deliveries will begin in the second quarter to Chevrolet’s first 340 fleet customers, with production ramping up later this year.

Production costs remain a challenge, though. In its standard disclosure regarding forward-looking statements, GM noted its performance partially hinges on the ability to cut costs associated with manufacturing and selling its EVs.

Ford

Ford’s EV push is centralized in its “Ford Model e” business arm. Unlike other companies in this roundup, Ford’s latest quarterly earnings report doesn’t share specific figures for EV sales. Overall, the Michigan car giant closed the first quarter with $41.5 billion in revenue, up 20% year-over-year. The release mentions that quarterly EV shipments and revenue were limited due to production interruptions for its popular Mustang Mach-E SUV and F-150 Lightning pickup. The former required industrial changes to boost its manufacturing capacity by nearly double, while the latter paused to fix a battery issue.

Ford’s monthly U.S.-specific sales report sheds more light on its EV performance. In April 2023, the company sold 3,499 EVs and 11,282 hybrid vehicles to American customers—a tiny portion of its total 184,002 vehicle sales. Its year-to-date EV sales stand at 14,365, up 16.1% from 2022, and its hybrid vehicle sales total 40,332, down 4.9%.

Ford targets a global run rate of 600,000 EVs by the end of this year and over 2 million by late-2026. Last summer, the company announced it secured all of the annual battery cell capacity required to reach the 2023 target, and it’s 70% of the way towards its 2026 goal.

In March, Ford introduced an all-electric Explorer crossover for the European market. It is boosting production capacity for Mustang Mach-E, F-150 Lightning, and E-Transit models. Earlier this year, Ford unveiled plans to manufacture a new electric pickup model at its upcoming mega campus in Tennessee, capable of building 500,000 EV trucks annually at full production. Called Project T3, for now, the next-generation electric truck will begin production in 2025.

Video used courtesy of Ford Motor Company

To further ramp up production, Ford is transforming its existing plant in Canada to manufacture batteries and future EVs. It’s also building a lithium iron phosphate battery plant in Michigan.

Toyota

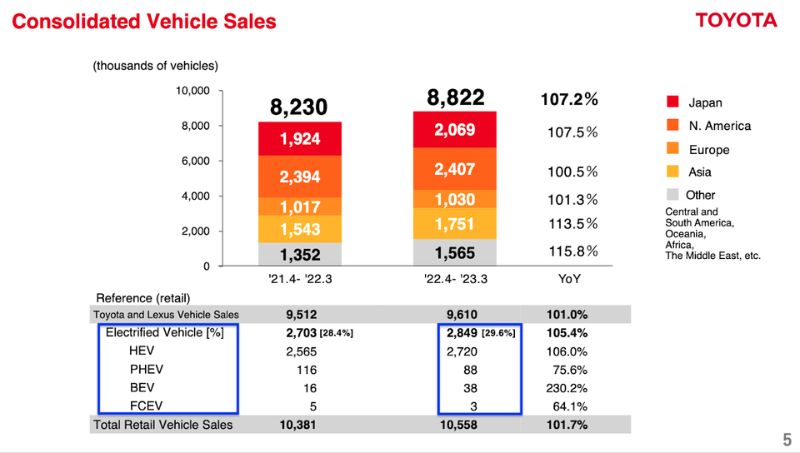

Japan-based Toyota Motor Corporation released its fiscal year 2023 results last week, with 37.154 trillion yen ($273 billion) in revenue from April 2022 through March. The company sold 2.8 million electrified vehicles globally, a slight increase from 2.7 million in last year’s annual results. This equates to 29.6% of 9.6 million total sales across Toyota- and Lexus-branded vehicles.

Almost all of Toyota’s electric units sold in 2022 were hybrid electric vehicles (HEVs), followed by plug-in hybrids, battery EVs (BEVs), and fuel cell EVs. In its 2024 fiscal year, the company forecasts 3.8 million EV sales and 9.6 million total.

A slide from Toyota’s fiscal-year 2023 earnings results (emphasis on EV data added by EE Power). Image used courtesy of Toyota Motor Corporation

Toyota is unique from the other companies covered here because it’s pursuing a more phased strategy for its BEV expansion, while its competitors are going all-in on batteries. Toyota is diversifying its lineup of alternative vehicles by investing in hydrogen fuel cell EVs such as its Toyota Mirai. Toyota Motor Corporation President and CEO Koji Sato has discussed plans to advance fuel cell projects in the commercial market, especially in Europe and China, where hydrogen consumption is high. In Asia and emerging markets expected to grow at least 30% per year by 2030, the company will focus on HEVs to capture continued trends.

The company aims to achieve a BEV base volume of 1.5 million sales by 2026. Until then, it plans to add ten more models, mainly in the U.S. and China, to its BEV lineup, including new SUVs, compact cars/sedans, and commercial vehicles. The company is known for staple hybrids like the Prius, but its growing electric lineup includes newer names such as the bZ4X SUV, the bZ3 sedan, and the luxury Lexus RZ and UX.

Volkswagen

Germany-based Volkswagen is another emerging EV player, selling popular models such as the ID.3 hatchback and ID.4 SUV, the Audi all-electric e-tron family, and the Porsche Taycan all-electric sports car.

Volkswagen Group reported strong numbers in its first-quarter earnings, released earlier this month with 76.2 billion euros ($83.2 billion) in revenue. In 2023, the company delivered 141,023 all-electric vehicles worldwide in just the first three months—of which two-thirds were centralized in Western Europe. This marks a 42.1% jump from the same time last year.

BEVs now claim 7% of Volkswagen’s total deliveries. Meanwhile, it delivered 55,756 plug-in hybrid models last quarter, up 9.1%.

Volkswagen is increasing its production capacity to meet global demand. It’s building its second battery cell factory in Sagunt, Spain, opening in 2026 with an annual capacity of 40 gigawatt-hours (GWh) and potentially expanding to 60 GWh. It also selected Ontario, Canada, for its first battery gigafactory outside Europe, targeting production in 2027. And in March, VW announced it would build a production facility for its Scout Motors Inc. brand in South Carolina, bringing an annual capacity of 200,000 units for Scout’s SUV and pickup on a new all-electric platform. Construction will begin later this year.