Innovation Surrounds Growing EV Market in 2023

A look back at some of the power products and innovations from 2023 that are impacting the design of EV powertrains, battery systems, and vehicle charging infrastructure.

Spurred by growing demand for electric vehicles (EV) and incentives provided through government legislation like the Inflation Reduction Act, EV applications continued to be a major focus for power system designers, developers, and component manufacturers in 2023.

Volfinity Cell Contacting System. Image used courtesy of EE Power

The sheer number of new power products, technologies, and innovations impacting EVs and e-mobility platforms in 2023 is vast. Here are a few of the products, technologies, and industry developments representative of the innovation affecting the performance and capabilities of EV powertrains, battery systems, and charging platforms.

EV Powertrain Applications

For mobile platforms like EVs, size and weight are key, along with power density and conversion efficiency. Seeking more performance, including range and charge time, powertrain bus voltages continue to migrate higher, with 800 V now common for many vehicles and some pushing to 1000 V and beyond.

ID.7 electric vehicle from Volkswagen. Image used courtesy of VW

To meet the demanding application requirements, wide bandgap power semiconductors like silicon carbide (SiC) remain an important option in EV powertrains for their ability to operate at high voltages and temperatures while meeting automotive reliability requirements. Along with other power devices, SiC power switches are the building blocks for many bridge inverter circuits (traction inverter) driving AC electric motors from DC battery buses.

Securing Silicon Carbide Device Supplies

Recognizing the importance of SiC components to EV design and development, many electronic original equipment manufacturers (e-OEM) aggressively pursued long-term supply agreements with vertically integrated device manufacturers in 2023. Onsemi inked deals with VW, BMW, and Magna, while Borg Warner entered into a supply agreement with ST to use the company’s SiC die in Borg Warner’s Viper power modules. Vitesco Technologies and ROHM Semiconductor agreed on a $1 billion long-term supply partnership.

Device manufacturers were also busy securing supplies, with Wolfspeed announcing the $225 million expansion of an existing SiC wafer supply agreement with an unnamed device manufacturer.

Powertrain Components and Modules

With power density in mind, advances in SiC device packaging were important in 2023. Infineon expanded its SiC power portfolio with a new TO leadless (TOLL) packaging option for its 650 V CoolSiC MOSFET family. The company also announced improvements to its 1200 V TRENCHSTOP IGBT7 half-bridge power module.

High-voltage power modules continued to be popular for EV powertrain applications due to their compact size and ease of design. STMicroelectronics released the first model of the ACEPACK DMT-32 series of SiC power modules rated to 1200 V and capable of meeting the requirements of high voltage EV applications like traction inverters. Cissoid and Silicon Mobility expanded their partnership by releasing a comprehensive SiC inverter reference design for EV motor drive applications up to 350 kW/850 V.

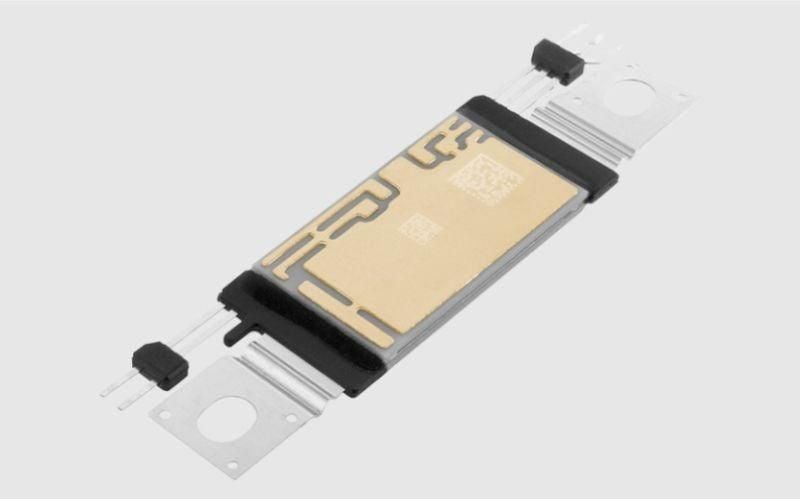

Viper 800 V power module based on SiC technology. Image used courtesy of EE Power

Not to be excluded from the high voltage powertrain market, Transphorm announced the first-ever 1200 V GaN-on-Sapphire power transistor capable of supporting the highest voltage traction inverter applications.

EV Battery Systems

Rechargeable battery packs, built primarily with lithium-ion battery cells, are the main energy source for EVs. The design, operation, and management of the battery pack and adjacent battery systems are essential to the performance, reliability, and safety of an EV. There were a multitude of battery system advancements in 2023.

Battery Cell Technologies

U.K.-based Ilika took the lead in an industry consortium chartered to advance the company’s solid-state battery technology that promises higher energy densities than traditional liquid electrolyte batteries.

Sion Power Corporation partnered with Citrine Informatics to use AI tools to enhance the development of their high energy density Licerion hybrid lithium-ion battery technology, while GM looked to AI to advance the design of batteries with an investment in low-cost cathode start-up Mitra Chem.

Using the company’s silicon anode technologies, Amprius Technologies unveiled their latest high-performance battery cell product, while XING Mobility’s immersion cooling technology was introduced with superior thermal management to allow for more dense battery packs.

Battery Management Systems (BMS)

Battery management systems (BMS) monitor and control EV batteries' charge and discharge cycles and are essential to an EV’s operation.

In 2023, Element Energy received $28 million in funding to advance its new BMS technology based on advanced monitoring of individual cells.

Operating out of Bordeaux, France, BMS PoweSafe developed the HiVO high voltage BMS platform, while Infineon partnered with Eatron Technologies to incorporate Eatron’s AI-based battery predictive analytics software into their latest battery management MCU platform.

BMW Group chose the Volfinity Cell Contacting System from Molex to simplify the battery interconnect design of their EV battery management systems.

Battery Manufacturing and Access to Materials

Reliable access to the materials needed to construct EV batteries sustainably remains a challenge to the growth of the EV industry. Li-Bridge, the public-private alliance formed by the US Department of Energy, announced their plan to speed up US domestic production of lithium-ion batteries, while American Resources Corporation invested in a subsidiary that is using chromatography techniques to recover rare earth metals from end-of-life batteries and magnets.

Expanding an existing partnership, ABB agreed to supply key electrification equipment to Northvolt’s Revolt Ett battery recycling facility.

Battery Life and Safety

Extending EV battery life is about more than just the battery tech. EV truck manufacturer Teva partnered with Tier 1 automotive supplier ZF to introduce a new regenerative braking platform for their EV trucks to extend battery life.

Safety remains a concern for the design of EV battery systems, as evidenced by Nikola’s voluntary recall of its Class 8 Tre battery electric vehicles due to a battery pack coolant leak.

Electric Vehicle Charging

There are two qualities EV drivers look for when it comes to charging their vehicles – reliable access to chargers and short charge times. And, of course, safety and reliability as well. 2023 yielded innovation on all fronts, along with the rapid deployment of public DC fast-charging networks supported through public-private partnerships.

Gallium Nitride and Onboard Chargers

For Level 1 and 2 charging applications that use a vehicle’s onboard charger (OBC) to access EV battery packs, GaN Systems announced their high power density OBC reference platform that uses the latest gallium nitride (GaN) technologies to deliver up to 11 kW of power.

GaN Systems also announced a partnership with ACEpower to speed up the adoption of GaN technology in the fast-growing Chinese EV market. In 2023, Infineon completed its acquisition of GaN Systems.

DC Fast Charging

As with powertrain traction inverters, wide bandgap SiC technologies are key in DC fast-charging solutions due to their high voltage capabilities and efficiency. DC fast chargers (Level 3 chargers) can charge a standard EV in well under one hour.

EV fast chargers for convenience stores. Image used courtesy of EE Power

Nexperia and onsemi announced partnerships with leading OEMs to use their SiC devices in DC fast-charging and OBC platforms. OmniOn Power entered the DC fast-charging market by introducing a 30 kW AC-DC supply targeted for EV fast charging.

Start-up Electric Era announced $11.5 million in Series A funding to enlarge their PowerNode EV fast-charging stations network for convenience stores that use AI to manage load balancing between the grid and local storage batteries.

Charge Monitoring

For charge metering applications, Italian company Carlo Gavazzi introduced a DC energy meter for fast charge systems and an AC energy meter for Level 1 and Level 2 charge metering.

PREMO, based in Spain, announced its new cable sniffer that uses inductive coupling principles to monitor CSS communications between vehicles and charging stations without contacting the high-voltage charging cable.

The Polytron Division of Daburn Electronics released board-mountable power modules for internal power system design in Level 1 and Level 2 EV chargers.