Beacon Power Corp. reported a net loss of $9.3 million, or ($0.20) per share for the fiscal year ended December 31, 2005, compared with a net loss in 2004 of $5.3 million, or ($0.12) per share. The higher loss in 2005 is attributable to the non-recurring gain on the sale of equity investments in Evergreen Solar, Inc., of $3.6 million in 2004, as well as higher spending in 2005 on several research and development contracts and nonrecurring expenses of $1.3 million relating to a proposed acquisition that was terminated.

For the fourth quarter of 2005, the company reported a net loss of $3.2 million, or ($0.07) per share, compared to net income of $0.9 million, or $0.02 per share, for the fourth quarter of 2004. This result is also primarily attributable to the nonrecurring gain on the sale of equity investments in Evergreen Solar, Inc., which were reported in the fourth quarter of 2004.

At December 31, 2005, the company had $13.9 million in cash and cash equivalents, compared to $5.1 million at December 31, 2004. The company's working capital was $13.2 million. In 2005, the company raised approximately $17 million through new investment. These funds will be used to develop and test its next-generation flywheel system, as well as begin development on the full-scale Smart Energy Matrix that is expected to provide frequency regulation services on the electricity grid. The company's cash and cash equivalents at December 31, 2005, will support its business plan into the first quarter of 2007.

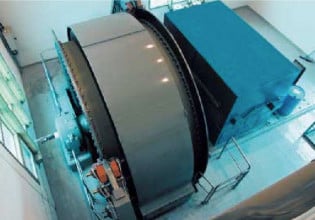

"2005 was a great year for Beacon Power in terms of the progress we made toward commercialization of our flywheel systems for frequency regulation," said Bill Capp, Beacon Power president and chief executive officer. "We signed several significant development contracts, designed and delivered our first demonstration system, and made substantial progress on the second system. Our plan to design, build, own and operate multiple 20-megawatt flywheel frequency regulation plants and generate long-term revenues from the services is based in part on what we'll learn from these demonstrations. Indeed, they provide invaluable opportunities to accelerate our progress toward larger-scale commercialization of high-energy flywheels for frequency regulation."

"In 2006, we expect to design and build our first 25kWh flywheel, which will be the core component of our Smart Energy Matrix," Capp continued. "We are hiring experienced engineers and other staff to help us complete this effort on schedule. We will also continue to pursue additional contracts, strengthen our relationships with grid operators, utilities and other potential partners, and identify new markets for our patented energy storage technologies."