Vicor Corporation reported financial results for the fourth quarter and year ended December 31, 2016 including: revenues for the fourth quarter ended December 31, 2016, decreased to $48,085,000, compared to $51,394,000 for the corresponding period a year ago, and decreased from $53,227,000 for the third quarter of 2016. Fourth quarter bookings increased to $55,082,000 from $46,636,000 for the corresponding period a year ago, and increased from $53,846,000 for the third quarter of 2016.

Gross margin decreased to $21,499,000 for the fourth quarter of 2016, compared to $22,831,000 for the corresponding period a year ago, and decreased from $25,923,000 for the third quarter of 2016. Gross margin, as a percentage of revenue, increased to 44.7% for the fourth quarter of 2016, compared to 44.4% for the fourth quarter of 2015, but decreased from 48.7% for the third quarter of 2016.

Net loss for the fourth quarter was ($2,688,000), or ($0.07) per share, compared to a net loss of ($1,752,000), or ($0.05) per share, for the corresponding period a year ago and net income of $2,336,000, or $0.06 per diluted share, for the third quarter of 2016.

Revenues for the year ended December 31, 2016, decreased 9.0% to $200,280,000 from $220,194,000 for the corresponding period a year ago. Net loss for the current year was ($6,247,000), or ($0.16) per share, compared to net income of $4,927,000, or $0.13 per diluted share, for the corresponding period a year ago. Included in net income for the third quarter of 2015 was a gain from equity method investment of $5,000,000, representing cash consideration received for the Company's investment in Great Wall Semiconductor Corporation ("GWS"), following the acquisition of GWS by Intersil Corporation in September 2015.

Cash provided by operating activities totaled $2,128,000 for the fourth quarter of 2016, compared to cash used for operating activities of $164,000 for the corresponding period a year ago. Cash and cash equivalents increased sequentially by $1,104,000 to approximately $56,170,000 at the end of the fourth quarter of 2016 from $55,066,000 at the end of the third quarter of 2016.

Total backlog at the end of 2016 was $48,371,000, compared to $42,124,000 at the end of the third quarter, and $39,073,000 at the end of 2015.

Dr. Patrizio Vinciarelli, Chief Executive Officer, commented on fourth quarter performance and the outlook for 2017, stating, "A nearly 10% sequential decline in quarterly consolidated revenue caused reduced manufacturing efficiencies, reduced product margins, and a quarterly loss. However, a sequential increase in consolidated bookings and a strengthening book-to-bill ratio bode well for sequential increases in quarterly revenues and profitability in 2017.

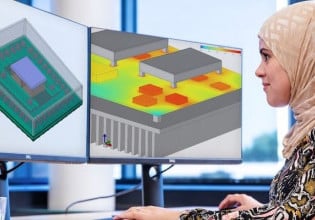

“Shipments of 48V to point-of-load solutions for datacenters rose 13% sequentially, with customers also placing orders for deliveries in Q1 and beyond. Design-in activity of advanced products in datacenter, supercomputing, autonomous driving, and aerospace applications accelerated, with first design wins for powering GPUs and for powering CPUs within the CPU package. This high level of activity and an improvement in bookings are indicative of increasing market traction enabled by our innovative and highly differentiated modular power components," concluded Dr. Vinciarelli.