Bel Fuse Inc. announced financial results for the second quarter of 2006, highlighted by a 16% increase in net sales to a new record. For the three months ended June 30, 2006, net sales increased 16% to a record $66,474,000 compared to net sales of $57,545,000 for the second quarter of 2005. Net income was $8,763,000, or $0.74 per diluted share, compared to $6,669,000, or $0.58 per diluted share, for the second quarter of 2005. This year's second quarter results included a pre-tax gain of $5,240,000 on the sale of the company's shares in Artesyn Technologies, Inc., offset by a $1,000,000 accrual (classified as an SG&A charge for accounting purposes) for performance bonuses awarded by the Board in connection with the Artesyn investment. Second quarter results also included a casualty loss of $133,000 for costs associated with the previously reported fire at Bel's leased manufacturing facility in the Dominican Republic. Production at this facility has returned to its pre-fire pace.

For the six months ended June 30, 2006, net sales increased 17% to a record $121,100,000 from $102,984,000 for the same period last year. Net income was $12,761,000, or $1.08 per diluted share. This compares to net income of $10,982,000, or $0.95 per diluted share, for the first six months of 2005. Results for this year's first half included a pre-tax gain of $5,151,000 on the sale of marketable securities (offset by the above-mentioned $1,000,000 accrual) and a casualty loss of $1,097,000.

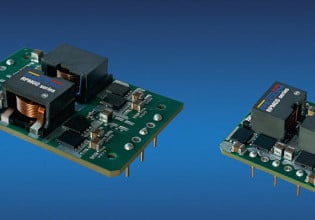

"Second quarter sales of circuit protection products were the best in six years. Record results also benefited from strong sales of dc-dc modules, integrated front end modules acquired from APC and strong growth of interconnect devices manufactured by Stewart, a division we acquired from Insilco. Stewart and APC both achieved record sales for the quarter and we are extremely pleased with their progress since their acquisition three years ago," said Daniel Bernstein, president of Bel.

"Our record revenue is especially noteworthy in view of the difficult environment in the global electronic components industry. The volatility of raw materials prices, higher energy and transportation costs and the fire at the Dominican Republic facility affected Bel's second quarter profitability," Bernstein said. "We plan to continue to grow our business both internally and through appropriate acquisitions," Bernstein added.

On July 13, 2006, Bel announced that its 100% subsidiary Bel Ventures Inc. had acquired 4,900,000 shares of stock of Toko, Inc., corresponding to 5.0% of Toko's total outstanding shares. Toko is a manufacturer of voltage regulators, choke coils, inductors, inverters and converters, white LED drivers, LC and other filters interface modules and wireless LAN modules. "Bel has presented to Toko's management ways to combine the respective strengths of the two companies, and we are hopeful that we will resume discussions with Toko to determine how best to maximize shareholder value for both companies. We are reviewing our various strategic options before we determine how best to move forward," Bernstein said.