Study Reveals How Drone Efficiency Compares to EVs, Diesel Trucks

A new study from Argonne National Laboratory compares the efficiency of delivery drones, electric vehicles, and diesel trucks against wind conditions in Chicago. Here’s how they fared.

In theory, direct delivery drones may eventually become competitive with longstanding diesel trucks and the e-commerce industry’s growing fleet of battery-electric vehicles (BEVs). But the specifics depend on surrounding wind conditions. A new study from the U.S. Department of Energy’s Argonne National Laboratory sought to understand this dynamic by comparing the three transport methods to see which is most efficient in the Chicago metropolitan area.

A drone transports a package through Walmart’s DroneUp delivery network. Image used courtesy of Walmart

The study, published in the Transportation Research Record, found that on an “average windy” day (10 miles per hour), delivery drones needed 15.8% more energy than BEVs but 73% less energy than diesel trucks. And on “very windy” days (20 miles per hour), they require five times as much energy as BEVs and 15% more than diesel trucks.

Given these findings, “one can infer that drone delivery in windy areas may be something to avoid,” said Taner Cokyasar, one of the paper’s authors and a consultant in Argonne's Transportation and Power Systems division.

Cokyasar told EE Power that while there are benefits in drone delivery, such as reduced delivery lead time and lower environmental impact (if deployed optimally), wind still has a substantial influence on energy requirements.

In 2021, UPS and Verizon-owned Skyward announced a partnership to deliver retail products with drones linked to Verizon’s 4G LTE network in Florida. Image used courtesy of UPS

Indeed, weather conditions are a significant barrier to mainstream adoption of delivery drones. Carol Tome, chief executive officer of UPS, admitted as much at an event in January 2022, noting that one of the issues with drones is you can’t fly them when it’s windy or rainy.

However, Cokyasar said wind isn’t always the enemy of drones. In some cases, it helps drones consume less energy.

“Direction of wind and the angle of impact considerably affect our conclusions about drone delivery effectiveness in a particular area,” Cokyasar said. “Practitioners should utilize historic wind data while determining which customer to serve by drones.”

Quantifying the Energy Impacts of Drone Deliveries

Cokyasar said the research team considered extreme cases where drones would battle wind throughout their commutes.

“We assumed that drones are so unlucky that they are exposed to wind at a 90-degree angle in both delivery directions: from depot to customer and the reverse commute,” Cokyasar said. “This is not impossible in Windy City, Chicago.”

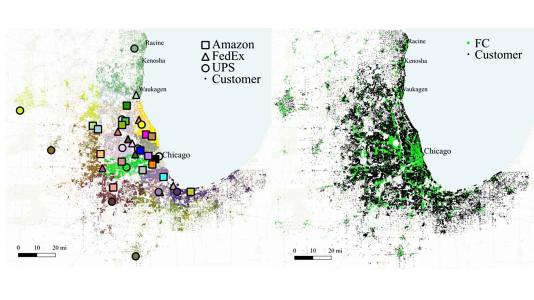

The researchers developed methods to quantify the regional energy impacts of drone and truck deliveries. They used an optimization model to find the ideal set of fulfillment centers with variable service capacities for direct e-commerce deliveries.

Argonne researchers modeled the best routes and number of vehicles needed for deliveries: The left image shows truck routes and depots to customer locations, while the right depicts fulfillment centers and customer locations for drone deliveries. Image used courtesy of Argonne National Laboratory

They also adopted two drone delivery estimation models from existing literature and developed another for diesel truck and BEV consumption. The researchers then tested the models against simulation data covering the Chicago metro area, considering the effects of wind speed and flight patterns on drone efficiency.

Beyond Chicago, Cokyasar and colleagues intend to expand their research to other regions using Argonne’s POLARIS simulation tool, which aggregates data from major cities such as Detroit, Atlanta, Knoxville, and Chattanooga.

“Upon interest, we are planning to expand the coverage and even improve our modeling approach to find the sweet spot of demand share over drones and conventional delivery modes,” Cokyasar said.

Argonne’s press release mentions that energy consumption is just one of many points companies should consider in adopting delivery drones, alongside environmental and monetary factors. The laboratory cited an example that wind analysis and routing algorithms could help determine when drones should be sent from a truck’s roof at ideal release locations.

Cokyasar shared a few other potential use cases with EE Power: Drones could be recharged with platforms on top of lamp posts to boost battery endurance and enable longer distances. Or they could wirelessly recharge mid-air, which is faster (taking about six minutes) and eliminates cords.

Another opportunity lies in drones with battery-swapping functions.

“A few companies have already built automated battery swapping machines for different uses of drone operations,” Cokyasar said. “These machines can be adopted to let drones deliver to longer distances while hopping from one machine to another and swap their batteries.”

Zooming Out: Drone Delivery Market Heats Up

Argonne’s findings open up new considerations in the budding drone delivery market. The industry is still relatively nascent as only a handful of companies have been certified by the U.S. Federal Aviation Administration to deliver packages with drones, including industry giants Amazon and UPS Flight Forward, alongside California-based drone delivery provider Zipline and Google-owned Wing Aviation.

Ultimately, cost remains a critical barrier to mainstream drone adoption for deliveries. A recent analysis from McKinsey & Company mentioned that most regulations require a visual observer to monitor drone airspace, and only one drone can be operated at a time. For that reason, labor accounts for up to 95% of the total cost of drone delivery—making it not cost-competitive with electric vehicles and conventional internal combustion engine vans.

This chart compares the cost and emissions of delivery drones, electric cars and vans, and internal combustion engine vans. Image used courtesy of McKinsey & Company

But that doesn’t mean the industry is slowing down. Insider Intelligence estimates that the number of retail delivery drone units in the U.S. will increase from 35,000 at the end of 2022 to more than 110,000 in 2024.

Some of the world’s leading companies are jumping in: Amazon recently launched its Prime Air delivery service last December, serving customers in California and Texas with plans to expand to more cities over time. Meanwhile, Walmart completed more than 6,000 drone deliveries in 2022. The grocery giant has 36 U.S. stores across seven states with drone delivery hubs operated by third parties such as Zipline. Most of its Neighborhood Market items meet the 10-pound weight requirement for drone delivery.