Vicor Reports Intel Delays Depress Current Financial Performance

Vicor Corporation reported revenues for the fourth quarter ended December 31, 2015 decreased to $51,394,000, compared to $60,735,000 for the corresponding period a year ago, but increased from $48,664,000 for the third quarter of 2015. Fourth quarter bookings decreased to $46,636,000 from $62,336,000 for the corresponding period a year ago, and decreased from $50,368,000 for the third quarter of 2015.

Gross margin decreased to $22,831,000 for the fourth quarter of 2015, compared to $26,116,000 for the corresponding period a year ago, but increased from $21,286,000 for the third quarter of 2015. Gross margin, as a percentage of revenue, increased to 44.4% for the fourth quarter of 2015, compared to 43.0% for the fourth quarter of 2014, and 43.7% for the third quarter of 2015.

Net loss for the fourth quarter was ($1,752,000), or ($0.05) per share, compared to a net loss of nil, or ($0.00) per share, for the corresponding period a year ago and net income of $2,503,000, or $0.06 per diluted share, for the third quarter of 2015.

Revenues for the year ended December 31, 2015, decreased by 2.5% to $220,194,000 from $225,731,000 for the corresponding period a year ago. Net income for the current year was $4,927,000, or $0.13 per diluted share, compared to a net loss of ($13,887,000), or ($0.36) per share, for the corresponding period a year ago. Included in net income for the third quarter of 2015 was a gain from equity method investment of $5,000,000, net of taxes, representing cash consideration received for the Company's investment in Great Wall Semiconductor Corporation (GWS), following the acquisition of GWS by Intersil Corporation in September 2015.

Cash used for operating activities totaled $164,000 for the fourth quarter of 2015, after adjusting for the deconsolidation of a noncontrolling interest, compared to cash provided by operations of $740,000 for the corresponding period a year ago. Cash and cash equivalents decreased by $5,591,000 to approximately $62,980,000 at the end of the fourth quarter of 2015 from $68,571,000 at the end of the third quarter of 2015.

Total backlog at the end of 2015 was $39,073,000, compared to $43,344,000 at the end of the third quarter, and $54,249,000 at the end of 2014.

Regarding the fourth quarter and full year, Dr. Patrizio Vinciarelli, Chief Executive Officer, commented, "Vicor revenue and profitability came in short of our expectations for 2015. As indicated before, Vicor revenue should be approaching an inflection point with expanding penetration of next generation datacenter servers and supercomputers by our 48V Factorized Power Architecture solutions. However, delays in the delivery of Intel's VR13 processors have deferred our anticipated revenue ramp. Vicor's power system business remained a steady contributor throughout 2015, despite challenging market conditions.

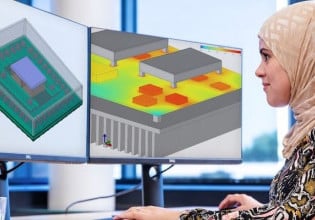

“New solutions, enabled by our high efficiency, high density ChiP modules and VIA packages, are beginning to penetrate legacy and emerging markets and should also contribute to improved performance. Vicor introduced an unprecedented number of new products during 2015, with broadening families of ChiP modules, ChiPs in VIAs, and SiPs. These unique modules, reflecting our Power Component Design Methodology, enable the most advanced, highest performance source-to-load power conversion solutions available. New product introductions will occur at an accelerating pace throughout 2016. I am confident that customer enthusiasm for our state-of-the-art power component and systems capability will give rise to sustained revenue growth,†concluded Dr. Vinciarelli.