Germany1 Acquisition Ltd., a special purpose acquisition company, has signed an agreement to acquire 100% of the shares of AEG Power Solutions B.V. for cash and shares assuming an enterprise value of €532 million.

The base consideration payable to the sellers consists of 200 million in cash and 19,208,955 registered convertible shares in Germany1. The consideration will be adjusted to account for closing date net cash and working capital and is also subject to an earn-out in cash and convertible shares of Germany1 valued at up to €50 million based on the achievement of certain performance targets with respect to fiscal years 2009, 2010, and 2011. Germany1 will shortly post a proxy statement on its website and call for an annual general meeting of its shareholders to consider and vote upon its proposals.

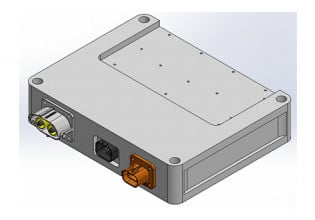

For over 60 years, AEG PS has been a world leading power electronics company built on world class German and pan European engineering and operational expertise providing market leading technology from its historical base in Belecke, Germany and throughout Europe. With 1,600 employees across 16 countries, AEG PS provides precision, mission critical, highly engineered power electronics solutions for industrial, renewable and infrastructure applications. AEG PS is the world leading supplier of power controllers to manufacturers of polysilicon, a major component of the solar energy industry. In 2008, AEG PS generated revenues of 343 million and EBIT of 56 million. The transaction marks the re-emergence of the AEG name, an iconic symbol of German industrial strength, back to the public markets.

Germany1 will submit the acquisition for final shareholder approval at its annual general meeting to be held on 12 August 2009. Germany1 has already entered into irrevocable undertakings or other similar arrangements with some of its shareholders who, in the aggregate, hold in excess of 70.1% of our public shares, pursuant to which they have agreed to vote their public shares in favour of the acquisition and related resolutions and/or not request redemption of their public shares. Therefore, assuming these shareholders vote in accordance with their commitment, the acquisition will be approved at the annual general meeting even if the remaining shareholders vote against the acquisition.

Florian Lahnstein, CEO of Germany1 said, "We are extremely satisfied to have found in AEG PS a company that matches our investment criteria. When we raised the SPAC in 2008, we set out to find a German hidden champion, and that is exactly what we have done. AEG PS is well positioned for growth in the renewable energy and industrial markets and we look forward to supporting the business as it continues in its development."