Dialog Semi Acquires Adesto Technologies

With expected sales growth and the addition of IC and embedded systems products to the company’s portfolio, Dialog Semiconductor’s Industrial Internet of Things (IIoT) expansion is underway with the acquisition of Adesto Technologies.

U.K. semiconductor manufacturer Dialog Semiconductor has completed its acquisition of Adesto Technologies, which manufactures integrated circuits and other embedded systems for Industrial IoT (IIoT) applications.

The deal is slated to boost Dialog’s growth targets in the IIoT market. Adesto, a 270-employee company based in California, owns a diverse product portfolio including communications ICs for commercial building management, non-volatile memory products, mixed-signal ASICs, smart home sensors and other IoT devices, and systems and network management software—all solutions meeting high demand in automotive navigation systems, connected medical devices, smart building control, and other applications. Dialog first announced the acquisition in February and the deal was officially completed in late-June. Under the terms of the deal, the company would acquire Adesto for $12.55 per share in cash, amounting to a value of around $500 million.

Headquartered in the U.K. and employing more than 2,000 people across 30 offices worldwide, Dialog Semiconductor has spent the past several years growing its mixed-signal IP portfolio and investing heavy R&D into its target markets.

According to Dialog’s 2019 report to investors, the company recorded around $1.5 billion in revenue across all of its product segments. The bulk of revenue, 68%, was claimed by the company’s custom mixed-signal products. Advanced mixed-signal products made up 18% of the overall revenue, followed by connectivity/audio at 13%.

An infographic from Dialog Semiconductor’s 2019 annual report describes the company’s long-term revenue strategy. (Source: Dialog Semiconductor)

Last year was a key point in Dialog’s long-term strategy to diversify its mixed-signal business. In April of 2019, Dialog closed a $600 million licensing deal with Apple, agreeing to transfer its power management patent licenses and assets, as well as 300 employees. After this transaction, Dialog shifted its long-term revenue goals to “reduce customer concentration” and “rebalance the end-market exposure” of the business, as stated in the company’s 2019 annual report.

This move translates to relying less on IP licensing revenue and more on new custom mixed-signal and automotive products, as shown in the infographic below.

The Adesto acquisition isn’t the first recent step Dialog has taken to enhance its IIoT segment. Last October, the company acquired German IC supplier Creative Chips for $80 million.

The deal gave Dialog a solid entry point into the IIoT sector, also boosting its existing mixed-signal business unit.

Through the Adesto acquisition, Dialog will gain access to more than 5,000 customers, mostly new to the company. With expected sales growth, as well as the addition of new in-demand products to the company’s portfolio, Dialog’s IIoT expansion is underway with the close of the Adesto deal.

In a news release announcing the close on June 29, Dialog CEO Jalal Bagherli wrote that the acquisition “immediately adds scale” to the company’s IIoT business, expanding the customer base with a wide portfolio of industrial products.

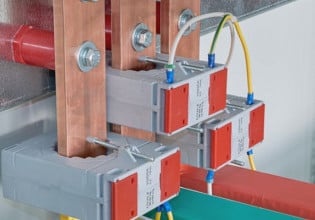

“With the combined product portfolio, we now have the unique ability to connect and control from the factory automation line and building automation systems to the cloud,” Bagherli said.