Electric Drive Modules–Driving EVs Farther and Faster

Carmakers are targetting zero emissions and looking at weight reduction and introducing fuel-efficient engines to reach that goal.

The automotive industry is targeting zero emissions for obvious reasons: Transportation accounts for one-fifth of global CO₂ emissions, of which road transportation contributes the most at approximately three-quarters.

As the population continues to expand and travel demand increases after a COVID hiatus of almost two years, the need to curb transportation emissions has governments setting targets for increasing fuel efficiency and reducing emissions worldwide–with the U.S. and Europe at the fore.

The figure below shows fuel efficiency targets by country.

Image used courtesy of Stratview Research

The automakers’ quest to meet the targets led them to explore possibilities mainly in weight-reduction and introducing fuel-efficient engines or zero-emission vehicles. Research suggests that a reduction in vehicle weight by 10% leads to an improvement in fuel economy by up to 8%.

The Rise of Electric Vehicles and Electric Drive Modules

Having electric vehicles in the product portfolio has garnered priority from automakers worldwide. The total number of e-Cars sold in 2021 crossed 6.5 million and is expected to grow rapidly in the coming years.

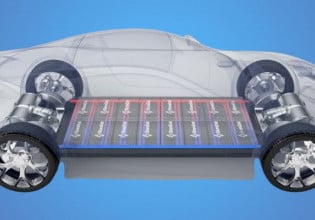

To make electric vehicles lighter, perform better, and a viable alternative for customers, OEMs have been working on the upgradation of the structure, performance, weight, and more. One of the most exciting advancements in this way is the development of an EV Drive Module (eDM).

What Is an Electric Drive Module?

Automakers need efficient electric power train systems that can easily integrate into the existing vehicle platforms to bring better-performing electric vehicles to the road cost-effectively. Advanced electrification solutions like eDMs are used to meet this need.

An eDM simply integrates electric motor, transmission, and power electronics into one unit, making the entire system much lighter. This integrated module helps convert DC from the battery into AC and ensures necessary torque is supplied to the drive system.

Functioning of eDM in EVs. Image used courtesy of Stratview Research

Benefits of Electric Drive Modules

This ‘all-in-one’ modernized electric drive module system eliminates unnecessary mechanical interfaces, helping OEMs attain a remarkable reduction in weight by 20%, size by 15%, and cost by 30%, approximately.

EDMs offer the following benefits.

- Compact–A single unit holds together all the key components making the eDM compact and offering installation flexibility.

- Less emission–Electric drive modules significantly reduce exhaust gas and noise emissions.

- Lesser battery consumption–High system efficiency ensures greater electric range or lower battery capacity requirements.

- Scalable–Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) can adapt this system according to different payloads.

- Cost efficient–eDMs integrated systems save the components and expensive connecting cables, lowering the price of EVs.

OEMs Leading the Pack

Owing to several benefits offered by these compact modules, their penetration is rising in EVs.

As of 2021, annual sales of eDMs were estimated at $5.7 billion. This figure will likely increase three times in the next five or six years.

A major chunk of global eDM sales is held by a few companies, including mainly OEMs and a few tier players, with Tesla at the helm. Leading EV manufacturers like Tesla, Nissan, etc., rely on in-house capabilities to manufacture eDMs.

Listed are several initiatives related to electric powertrains worth mentioning.

- As part of Nissan's midterm plan, Nissan MOVE to 2022, the company plans to extend its leadership in electric vehicles, symbolized by the world's best-selling all-electric vehicle in history, the Nissan LEAF. The e-Powertrain in LEAF powers the EV and removes the need for an internal combustion engine. It is a lightweight, compact system that produces extremely low vibrations and generates instant torque.

- Likewise, Tesla’s Model S and Model X drivetrains unite powertrain and battery technologies for unparalleled performance, range, and productivity. Its new module allows faster charging and gives users more power and endurance in all conditions. The Tesla Model 3, also a compact executive sedan, was promoted as being more affordable to customers than its previous models. In June 2021, the Model 3 became the first electric car to pass one million global sales. Most of the Tesla models are e-passenger cars, sedans, and crossover vehicles, but plans to release Tesla’s first electric light-duty truck in 2022 are underway.

- Yet another giant, Volkswagen, has introduced its EV platform “Modular Electric Drive Matrix” (MEB), based on which the group plans to build 27 models across its four brands worldwide by the end of 2022. All these new-gen vehicles are designed using high-performance batteries and modular designs.

- BorgWarner’s iDM146 integrated drive module (iDM) is set to power an additional ‘A Segment’ electric vehicle platform by Hyundai Motor Company (HMC), scheduled to start production in the 3rd quarter of 2024. Its modular design allows power and torque output to be scaled specifically to customer requirements.

- American Axle & Manufacturing AAM’s e-drivetrain will power Mercedes AMG’s first plug-in hybrid electric (PHEV) model, GT 63 SE Performance. It will provide a power/torque output of 150 kw/204 hp, adding performance in hybrid drive, and it will also help enable zero emissions.

Automakers’ Effect on Electric Drive Module Market

OEMs' interest in replacing conventional ICE engines with electric ones is quite apparent.

- Volkswagen revealed that half of its sales would be electric by 2030, and by 2050, the group intends to operate fully climate neutral.

- Ford expects 40% to 50% of its global vehicle volume to be electric by the end of 2030.

- Toyota, the largest car manufacturer worldwide, has announced new investments to achieve electric car sales of 3.5 million annually by 2030.

- Mercedes says that beginning in 2025, all newly launched vehicles will be fully electric.

- BMW aims for 50% of its vehicles sold to be fully electric by 2030 or before.

- Dongfeng, China’s leading automobile manufacturer plans to electrify 100% of its new models of passenger car brands by 2024.

Who Leads the EV Charge?

The increase in EV sales in 2021 was primarily led by China, accounting for more than half of total new EV sales (53%). Sales volume of EVs with e-drive modules in China reached a total of 3.3 million in 2021, followed by Europe with 2.3 million and the U.S., reaching 630,000.

According to the China Passenger Car Association (CPCA), EV sales could reach 6 million units in 2022.

Worldwide sales and sales market share of electric cars, 2011-2021. Image used courtesy of Stratview Research

Other countries in Asia-Pacific regions like Japan, India, and South Korea also have promising growth prospects with a supportive policy framework and high ambitions. This space in Asian countries is worth watching for the next decade and will prove to be a huge market for eDMs.

The Future of Electric Drive Modules

The growth of the electric drive modules is closely linked to the demand for electric vehicles, and the road toward an EV future is not without potholes. While the industry has highly ambitious plans for EVs, the world is not prepared with enough charging infrastructure.

The exorbitant prices of lithium are an added issue due to shortage and rising demand. The upward price trajectory continues unabated in 2022, hitting the automakers’ bottom line hard. Recent investment plans of Chinese EV giant BYD to buy lithium mines in Africa reinforce the trouble the industry is facing.

The sudden spike in electricity prices in Europe due to the tumultuous political environment has made the future of EVs vulnerable. Although the momentum created due to environmental concerns and favorable policies will likely keep the demand for EVs soaring in the coming decade, OEMs will have to revisit their strategies to keep themselves going.

The industry will compensate for the rising input costs with innovations like eDMs.

Featured image used courtesy of Adobe Stock