Aquion Energy Inc., the developer and manufacturer of Aqueous Hybrid Ion (AHI™) batteries and energy storage systems, has filed a voluntary petition under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court of the District of Delaware.

Immediately preceding the Chapter 11 filing, the Company retrenched to a core R&D team by terminating approximately 80% of its personnel (several of whom have also entered into consulting agreements with the Company to assist it in the sale of its assets), paused all factory operations, and stopped the marketing and selling of its products. These moves were made to provide the Company with sufficient time to proceed with an orderly process to sell the assets of the Company under the auspices of its Chapter case.

Over the past several years, Aquion has raised over $100 million from numerous sources including the business interests of Gigi Pritzker Pucker and Michael Pucker represented by DNS Capital, LLC, Constellation Technology Ventures, the venture capital arm of Exelon Corporation, Total Energy Ventures, Shell Technology Ventures, CapX Fund IV, LP, Bill Gates, Yung's Enterprise, Nick and Joby Pritzker through their family's firm Tao Invest, and Prelude Ventures.

"Creating a new electrochemistry and an associated battery platform at commercial scale is extremely complex, time-consuming, and very capital intensive. Despite our best efforts to fund the company and continue to fuel our growth, the Company has been unable to raise the growth capital needed to continue operating as a going concern," stated Scott Pearson, Aquion's outgoing Chief Executive Officer and Suzanne Roski, who is the now Company's Chief Restructuring Officer. Ms. Roski is a Managing Director at Protiviti, a Virginia-based consulting firm offering professional services around entering and exiting bankruptcy situations.

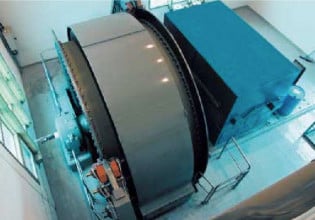

Filing for Chapter 11 provides the opportunity to sell the Company's assets and to maximize returns available to its creditors and stakeholders. Several potential strategic buyers have shown interest in Aquion and are conducting due diligence under non-disclosure agreements. According to Mr. Pearson, "A bankruptcy sale creates a unique opportunity for the right strategic buyer that can deploy transformative capital and synergies onto Aquion. Over its seven years of operation, Aquion has created a very promising energy storage platform and has proven that it can build a compelling product at scale in a highly-automated fashion and sell it globally to both integrators and end-customers. And in doing so, Aquion has captured many prestigious awards including: MIT's Top 100 Smartest Companies (2015, 2016), Global Cleantech - North American Company of the Year (2017), Platt's Energy - Rising Star Award (2016), and the EES Award for Energy Storage (2015)."

In the coming weeks, Aquion will be working to secure a bidder to purchase substantially all of its operating assets. The Company then intends to seek approval from the Bankruptcy Court for a competitive bidding and auction process to offer other interested bidders an opportunity to win the right to purchase the assets of the Company.