Move from 12V to 48V Power Buses Leads to Positive Results at Vicor

Vicor Corporation today reported revenues for the fourth quarter ended December 31, 2017 increased to $58,771,000, compared to $48,085,000 for the corresponding period a year ago, and increased from $56,888,000 for the third quarter of 2017. Fourth quarter bookings increased to $71,343,000 from $55,082,000 for the corresponding period a year ago, and increased from $64,280,000 for the third quarter of 2017.

Gross margin increased to $26,931,000 for the fourth quarter of 2017, compared to $21,499,000 for the corresponding period a year ago, and increased from $25,143,000 for the third quarter of 2017. Gross margin, as a percentage of revenue, increased to 45.8% for the fourth quarter of 2017, compared to 44.7% for the fourth quarter of 2016, and increased from 44.2% for the third quarter of 2017.

Net income for the fourth quarter was $1,611,000, or $0.04 per diluted share, compared to a net loss of $(2,688,000), or $(0.07) per share, for the corresponding period a year ago and a net loss of $(11,000), or $(0.00) per share, for the third quarter of 2017.

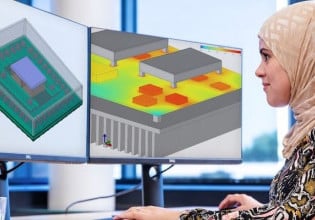

Commenting on recent developments, Dr. Patrizio Vinciarelli, Chief Executive Officer, stated, “The transition of XPUs (CPUs, GPUs and ASICs) to 48V, and away from legacy 12V infrastructure, is about to accelerate with the introduction of higher performance XPUs enabled by 48V.

Dr. Patrizio Vinciarelli

Dr. Patrizio Vinciarelli

“Early adopters and industry leaders are paving the way for broader conversion to 48V, and this emerging trend is beginning to reflect itself in our bookings performance: following third quarter sequential growth of 8%, fourth quarter net bookings grew 11% sequentially to $71 million. With $73 million in backlog as of year-end, we expect revenues to increase by 11% sequentially for the first quarter of 2018.

“With rising volumes, our advanced products have recently achieved profit margins exceeding those of our legacy bricks. As advanced products are forecast to make up a larger fraction of total revenue, revenue growth and margin expansion are expected to bring about significant earnings growth starting in the first quarter of 2018,” concluded Vinciarelli.

The Company recorded a net income tax benefit of $895,000 during the fourth quarter of 2017, contributing to the net income for the quarter. This net benefit was primarily due to the Company’s Alternative Minimum Tax (AMT) credit carry-forwards of approximately $736,000 becoming fully refundable in future years, due to the repeal of the corporate AMT under the recently enacted Tax Cuts and Jobs Act (H.R. 1).

Revenues for the year ended December 31, 2017, increased 13.8% to $227,830,000 from $200,280,000 for the corresponding period a year ago. Net income for the current year was $167,000, or $0.00 per diluted share, compared to a net loss of $(6,247,000), or $(0.16) per share, for the corresponding period a year ago.

Cash used for operating activities totaled $3,752,000 for the fourth quarter of 2017, compared to cash provided by operating activities of $2,128,000 for the corresponding period a year ago and cash provided by operating activities of $1,341,000 for the preceding third quarter of 2017.

Due to a net increase in non-cash working capital items brought about by the timing of certain transactions, cash and cash equivalents sequentially decreased by $4,706,000 to approximately $44,230,000 at the end of the fourth quarter of 2017 from $48,936,000 at the end of the third quarter of 2017.

Total backlog at the end of the fourth quarter of 2017 was $73,054,000, compared to $60,074,000 at the end of the third quarter, and $48,371,000 at the end of 2016.