Infineon Expands SiC Supplier Base

Infineon concluded a supply contract with Japanese wafer manufacturer Showa Denko, which offers high-demand silicon carbide (SiC) material.

German semiconductor manufacturer Infineon Technologies recently announced it concluded a silicon carbide (SiC) supply contract with Showa Denko, a Japan-based provider of epitaxial wafers—key raw materials for SiC power devices.

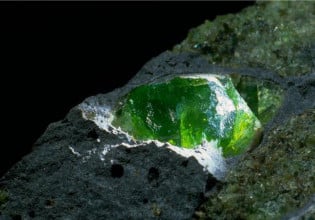

Photo courtesy of Infineon Technologies

Facing heightened demand for high-efficiency SiC materials such as epitaxy in the photovoltaic, industrial and electric vehicle charging markets, Infineon is gearing up to further diversify its supply base. Peter Wawer, president of the company’s industrial power control (IPC) division, stated in the announcement that the company’s SiC wafer supply expansions mark “an important step” in its multisourcing strategy.

“It will support us to reliably meet the growing demand mid to longterm,” Wawer added. “Furthermore, we plan to collaborate with Showa Denko on the strategic development of the material to improve the quality while cutting costs at the same time.”

In a presentation to investors earlier this month, Infineon said it’s diversifying its SiC raw wafer and boule supply base with multiple providers, including Showa Denko along with American semiconductor firms Cree and GTAT. The company will release a second-generation line of its CoolSiC Trench MOSFETs, now in the advanced development phase. The new line will feature 25% to 30% enhanced power handling capability, serving more high-volume applications.

In 2020, SiC devices accounted for a small sliver of revenue in Infineon’s industrial power control business, outshined by IGBT modules and discrete IGBTs. Looking forward, Infineon said in the presentation that it expects growth for almost all of its IPC target markets through this year.

That growth is projected to span its automation and industrial drives, renewables (wind and PV), home appliances, power infrastructure and other product segments. However, in the transportation market, Infineon noted that declining COVID-related travel caused “further push-out of construction of passenger trains and e-Busses.”

In its second-quarter 2021 earnings report released earlier this month, Infineon said its IPC segment revenue suffered a significant decline in the transportation sector. However, the loss was offset by growth in power infrastructure and home appliances, renewable energy and industrial drives. Overall, IPC segment revenue totaled €361 million (or about $436 million USD), slightly down from €362 million last quarter.