Zenergy Power Announces Institutional Placing To Raise € 9.5 Million

Zenergy Power plc announced that it has raised € 9.5 million (approximately € 9.1 million net) by way of a placing of 7,916,667 new ordinary shares of 1p each (‘Ordinary Shares’) in the company (Placing Shares’) at a price of 120p with a number of new and existing institutional investors (the Placing’).

Arranged by Panmure Gordon & Co. and Mirabaud Securities LLP, the Placing will provide the Group with additional working capital to expand its commercial activities in the United States whilst continuing to progress its ongoing research and development activities.

Zenergy specializes in the innovation and development of clean energy devices employing highly efficient superconductive components. These devices have a number of commercial applications including smart grid deployment and energy efficient industrial applications. Since the Group last raised funds in December 2007 these target markets have grown significantly and more recently have been directly selected as recipients of economic stimulus spending in the United States. The management of Zenergy believe that this spending in the United States is already manifesting itself in commercial opportunities for the Group’s products and has sought this additional funding to support an anticipated scale up of marketing, sales, manufacturing and administration in the region. As widely documented, there has been a coordinated and committed allocation of economic stimulus funding by the U.S. and other governments towards energy efficient and renewable technologies.

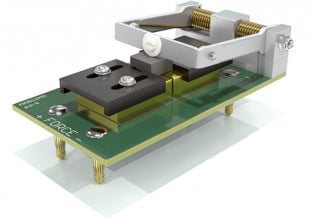

Within the United States in particular, the Director’s note two particular stimulus proposals within the American Recovery and Reinvestment Act of 2009 that will have a direct impact on the Group’s sales efforts. 1) The U.S. Government’s commitment to provide a 50%. funding program for electricity utility companies investing in smart grid technology; and 2) The U.S. Government’s commitment to provide a 50% funding program for industrial businesses making investments in energy efficient technology capable of reducing energy consumption by 25 per cent.. It is the Director’s belief that these two proposed government funded schemes in the U.S. have clear implications for the Group’s commercial prospects in relation to its Fault Current Limiter (`FCL’) and to its induction heater. Zenergy’s recent engagement by The Consolidated Edison Company of New York also highlights the commercial opportunities unfolding for the Group in the United States.

The Placing is conditional, inter alia, on the Placing Shares being admitted to trading on AIM. The Placing Shares will, on their issue, rank pari passu in all respects with the existing Ordinary Shares and have, subject only to Admission, been allotted and issued credited as fully paid. Application has been made for the Placing Shares to be admitted to trading on AIM, which is expected to be on or around 5 May 2009.

In addition to responding to the recent commercial developments occurring within the United States, the Group will also use additional funding to support its ongoing research and development activities that have demonstrated substantial progress since the Group’s prior funding round. These achievements include – but are not limited to – the installation and operation of the world’s first industrial scale superconductor device (induction heater) into commercial premises; the design completion, testing and completion of first ever installation into the United States’ electricity grid of a superconductor FCL; the establishment of a development collaboration with Honeywell Specialty Materials; and the selection for participation in development projects funded by the Department of Homeland Security, the German Environmental fund, the European Commission and the Department of Energy.