Highpower International Reports First Quarter 2011 Financial Results

Highpower International, Inc., a developer, manufacturer and marketer of nickel-metal hydride (Ni-MH) and lithium-ion (Li-ion) batteries and related products, announced financial results for the first quarter ended March 31, 2011.

Net sales for the first quarter ended March 31, 2011 totaled $27.0 million, a year-over-year increase of 33.3% compared with $20.2 million for the first quarter ended March 31, 2010. The increase in sales for the first quarter was primarily due to overall strong demand for our batteries, including a 51% increase in revenue for lithium-ion batteries as well as a $4.0 million increased contribution from our new materials business.

First quarter 2011 gross profit decreased 5.8% to $4.0 million, as compared with $4.2 million for the first quarter 2010. Gross profit margin was 14.8% for the first quarter 2011, as compared with 21.0% for the first quarter 2010. The year-over-year decrease in gross profit margin for the first quarter 2011 was primarily due to a rise in raw material prices, including nickel and rare earth materials.

Selling and distribution costs, including stock-based compensation, were $1.2 million for the first quarter 2011, as compared with $0.8 million for the comparable period in 2010, reflecting increased sales and marketing activities worldwide.

General and administrative expenses, including stock-based compensation, were $2.6 million, or 9.6% of net sales, for the first quarter 2011, as compared to $1.5 million, or 7.2% of net sales, for the first quarter 2010. The increase was primarily due to increased spending on senior and mid-level management staffing and increased investment in our management information systems, both of which are required to support the growth of our business.

Loss from operations for the first quarter of 2011 was $0.5 million, as compared with income from operations of $1.9 million for the first quarter of 2010. The 2011 results include a $0.17 million loss on the exchange rate difference between the U.S. Dollar ("USD") and the Renminbi ("RMB") as compared with a $0.02 million loss in the 2010 first quarter. Also included in these results were non-cash stock-based compensation expenses of $0.2 million and $0.1 million for the 2011 and 2010 quarters, respectively.

Net loss for the first quarter of 2011 was $0.5 million, or $(0.03) per diluted share, based on 13.8 million weighted average shares outstanding. This compares with first quarter 2010 net income of $1.6 million, or $0.12 per diluted share, based on 13.6 million weighted average shares outstanding. As previously mentioned, the 2011 first quarter’s results were negatively impacted by the recent dramatic increase in raw material costs, particularly nickel and rare earth materials.

"During the first quarter, our margins were negatively affected by substantial increases in raw material prices, including nickel and rare earth materials," said Mr. George Pan, Chairman and Chief Executive Officer of Highpower International. "Despite these headwinds, we still experienced strong end market demand and significant growth for both our Ni-MH and Lithium-ion batteries. We grew Li-ion sales by 51% year-over-year and Ni-MH sales by almost 10%."

"We remain confident that we will continue to see high demand for our products in 2011. We are seeing a strong appetite for higher capacity batteries, especially from emerging sectors such as energy storage systems and specialty smaller vehicles, which include electric bikes, golf carts, and wheelchairs. To that end, we are already seeing traction from our new subsidiary, Iconergy, which we formed earlier this year to focus on this lucrative market, with the order of 400 units of lithium-ion battery systems from a French distributor for electric wheelchairs and 100 units for golf carts that we announced earlier this week," concluded Mr. Pan.

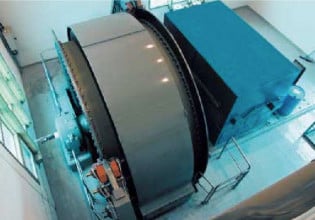

Henry Sun, Chief Financial Officer of Highpower International added, "Looking ahead, during the second quarter we are focused on implementing measures to offset margin pressures and increase our profitability. We are renegotiating yearly customer contracts, hedging, and implementing price adjustments with new customers to alleviate some of the pressure from commodity prices. We have already begun to see some positive trends from our efforts. Our balance sheet remains strong and we are on track for the opening of our new battery manufacturing facility in Huizhou, Guangdong Province before year-end."